What happens if you leave a gift to someone who died before you? 4 things to know about Florida’s lapse statutes for pre-deceased beneficiaries.

One question I get all the time in dealing with Florida Probate Litigation in Palm Beach County is, what happens when my mother whose deceased is left something in a will? Similarly you may be wondering, what if I put my mother in a will and she dies before me? This is the same legal dilemma, the Probate law deals with these through lapse and anti lapse statutes that you may have read about elsewhere. A 2010 case out of the Third District Court of Appeals in Miami Dade County is a good example of how the Florida anti-lapse statutes work. Also check out four things you should know about the anti lapse law in Florida.

- The case of Lorenzo v. Medina was decided in 2010.

- The testatrix’s (decedent or person who wrote the will) sister in law Juana R. Medina had an otherwise valid gift but had predeceased the testatrix.

- The trial court held as a matter of equity (i.e. fairness) the gift was valid even though the statute only applied to direct family members.

- The Appellate court reversed holding that the gift had lapsed and the statute must be strictly applied.

- Juana Medina’s heirs lost the inheritance and it was distributed pursuant to the residual clause of the testatrix, had that not existed the gift would be distributed intestate.

Here are four things you should know about lapse statutes:

- Historically, lapse occurs when the beneficiary or the “devisee” under a willpredeceases the testator, invalidating the gift. In other words, the beneficiary died first. The gift would instead revert to the residuary estate or be granted under the law of intestate succession. Florida enacted F.S. 732.603, an anti-lapse statute, to ameliorate the potentially harsh effects of this common law rule. Rather than lapsing, gifts covered by the statute go to a pre-deceased beneficiary’s descendants.

- Florida anti-lapse statue does not fix all lapsed gifts. It only applies to immediate family. So, gifts to neighbors, friends, and in-laws do not benefit from the statute. As the case above illustrates, there is no save for fairness here, courts must rigidly apply the law.

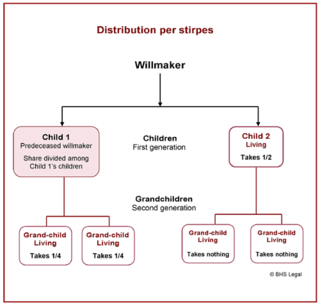

- If a gift is saved by the statute it goes to the predeceased heirs per stirpes. This means “by branch” in other words each separate branch of heirs will be given an equal share, see the visual at the top of the post as an example.

- If an ancillary probate occurs in another jurisdiction the other states’ lapse statutes may apply, consult an attorney.

Want to learn more check out our FAQ video library here: http://www.pankauskilawfirm.com